A payment terms clause in your Terms and Conditions agreement is where you disclose details such as how your business will process transactions electronically, what forms of payment you accept and what happens if the buyer cancels a transaction.

Payment terms clauses can help mitigate the risk of non-payment, provide protection against chargebacks, or leverage your intellectual property rights by restricting access to content until after the customer has paid.

Including payment terms in your Terms and Conditions will help protect your business and avoid disputes that could arise from a lack of clarity around these issues.

The following article will discuss the payment clauses you should ensure are written into your Terms and Conditions agreement.

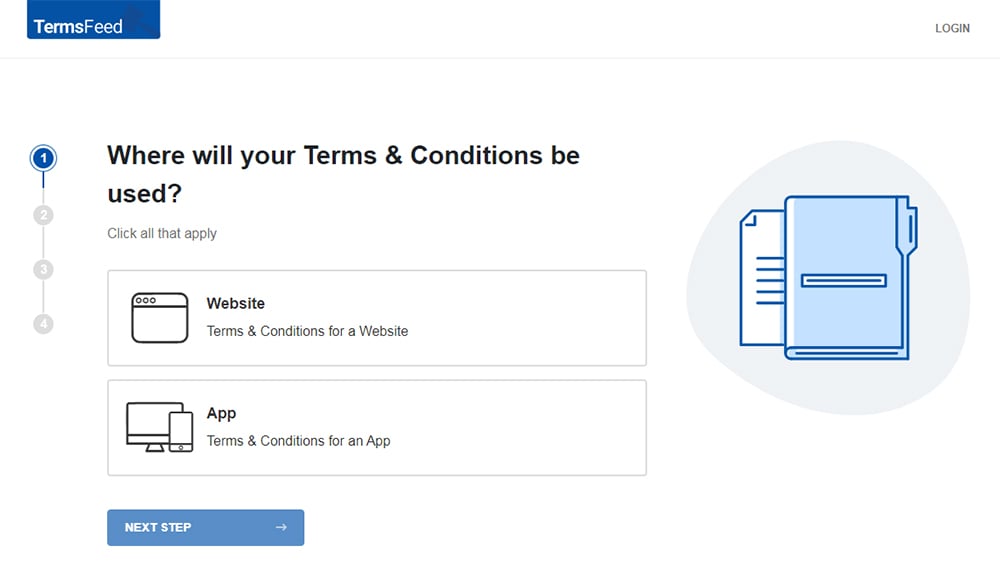

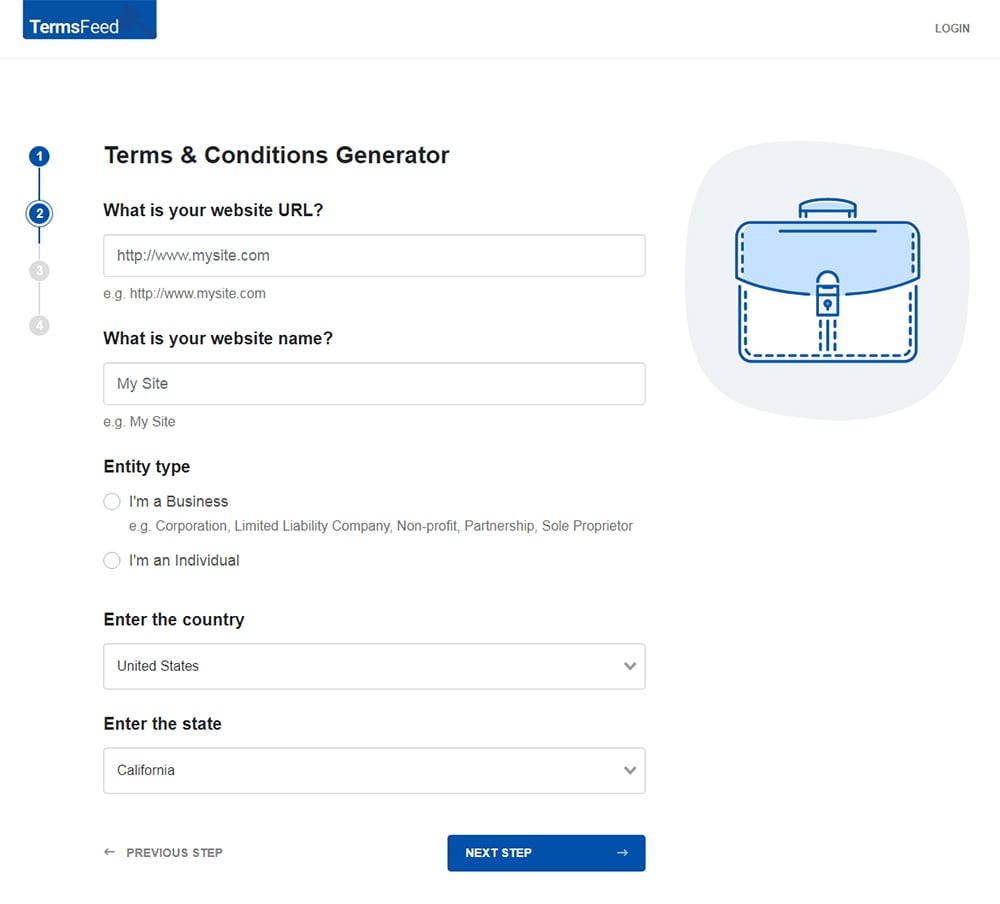

Our Terms and Conditions Generator makes it easy to create a Terms and Conditions agreement for your business. Just follow these steps:

-

At Step 1, select the Website option or the App option or both.

-

Answer some questions about your website or app.

-

Answer some questions about your business.

-

Enter the email address where you'd like the T&C delivered and click "Generate."

You'll be able to instantly access and download the Terms & Conditions agreement.

- 1. What are Terms and Conditions Agreements

- 1.1. Terms and Conditions Agreements Not Legally Required

- 2. What are Payment Terms?

- 3. Why Payment Terms Really Matter

- 4. Determining Payment Terms

- 5. What Payment Terms to Include in Your Terms and Conditions Agreement

- 5.1. When Payments are Due, Subscriptions, and Invoicing

- 5.2. What Payment Methods and Currency You Accept

- 5.3. Incentives and Offers for Customers (or Potential Customers)

- 5.4. What Happens if Payments are Missed or Not Received

- 6. Best Practices for Payment Terms Clause in Your Terms and Conditions Agreement

- 6.1. Use Plain and Polite Language

- 6.2. Set Specific Deadlines

- 6.3. Make Payment Periods Shorter

- 6.4. Include Late Fees and Enforce Them

- 6.5. Offer Flexible Payment Methods

- 6.6. Reward Customers Who Pay Early

- 7. Summary

What are Terms and Conditions Agreements

Terms and Conditions agreements (also known as Terms of Use or Terms of Service) are a contract between a business and its customers and users. It outlines the rights and responsibilities of both parties. Your users must agree to comply with your terms and conditions in order to use your product or website.

Now, you've probably seen Terms and Conditions called Terms of Service or Terms of Use agreements. Some people may mistakenly believe that these terms are separate agreements.

However, they're the same thing. There is no difference, and each of these terms is often used interchangeably on many major websites. It is the information within the page that matters most, and not the title.

See our Terms and Conditions FAQ for further information.

Terms and Conditions Agreements Not Legally Required

You should understand that although they aren't legally required, a formal Terms and Conditions agreement is very important to have and can greatly benefit your business.

Remember that a Terms and Conditions agreement is incredibly helpful in establishing a successful business relationship. By making your rules clear and writing them down, including payment terms, you can avoid any misunderstandings with customers.

What are Payment Terms?

Payment terms are the terms that govern the payment portion of a sale. They govern specific details such as the type and amount of payment expected, discounts offered, how the buyer can make the payment, under what conditions your company may assess late charges and more.

By defining the terms under which you expect customers to pay, you decrease the likelihood of:

- Late payments

- Poor cash flow

- A poor financial position for your business

Why Payment Terms Really Matter

When it comes to your payment terms, there is a lot at stake. These terms set the tone for future relationships with customers and can significantly impact your business's financial health.

When deciding on the terms to include in your Terms and Conditions agreement, it is essential to consider the industry standard and consider any financial consequences your terms might cause.

For instance, if a customer is late by 30 days on a payment, you might have to borrow money in order to pay your company's obligations. On average, it costs around 4% to do this on a monthly basis. It's equivalent to losing $400 if a customer fails to pay a $10,000 invoice within 30 days.

Your customer relationships will also be affected by your payment terms, and you may not get a penny if you place no time limit on when payment is due.

If you're a business that sends out invoices, it's essential to understand that invoicing clients at different stages of the work can cause delays or cause projects to stop entirely.

Determining Payment Terms

You should specifically tailor your payment terms to fit your company and the industry in which your business operates.

All businesses have the option to set their own payment terms. However, there isn't a one-size-fits-all approach. What works for one company often does not work for another.

For instance, some businesses may choose not to provide a due time and instead request cash upon delivery (COD) or up-front payment.

What Payment Terms to Include in Your Terms and Conditions Agreement

Your Terms and Conditions agreement's payment terms should include information that addresses when payments are due, what forms of payments you accept, any incentives or offers you have, and how you handle missed payments.

Let's look at each of these in further detail.

When Payments are Due, Subscriptions, and Invoicing

You'll want to make it very clear when payments are due if you aren't operating under standard payment terms where 100% of the payment is due at the time of purchase.

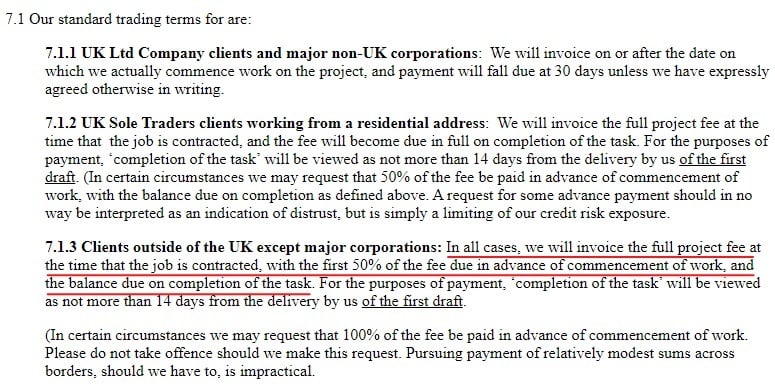

For example, if you're a freelancer or work under a format where you accept partial payments at different points, make this very clear.

Top freelance copywriter Laurence Blum includes payment terms that stipulate what portion of the payment is due in advance, as well as how the remaining balance is to be handled:

If you operate under a recurring or subscription payment plan, whether billed monthly, quarterly, annual or some other schedule, note this in your Terms and Conditions agreement. This type of payment is typically processed automatically, and the amount is exactly the same each time. When the business relationship between the company and the customer ends, recurring payments are canceled.

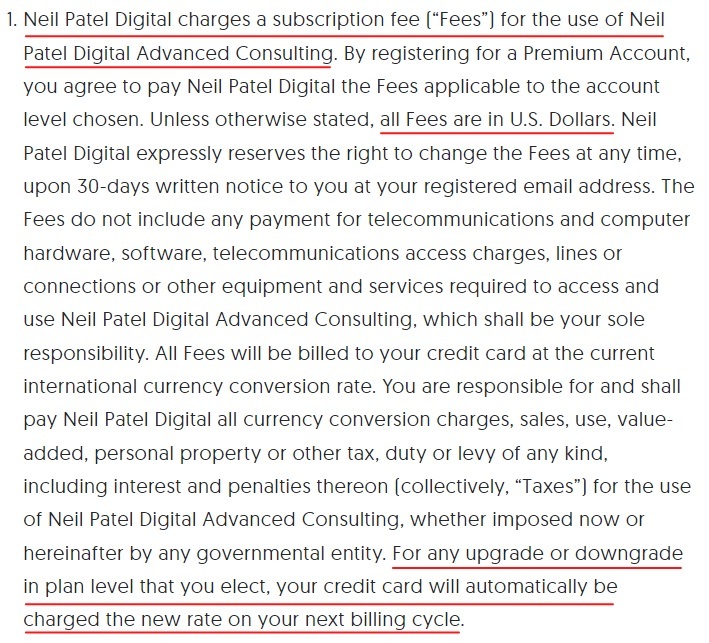

Here's how best selling author and marketing influencer Neil Patel notifies his customers about his subscription terms:

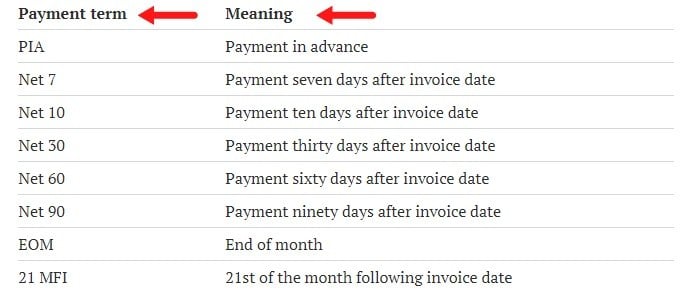

If you work with invoices, be very clear with the terms of invoicing. Include the number of days that customers have in which to pay the invoice in full. You can use the term "net" to refer to the specifics here.

Here's a chart from Go Cardless that provides some clear definitions of the various Net payment options:

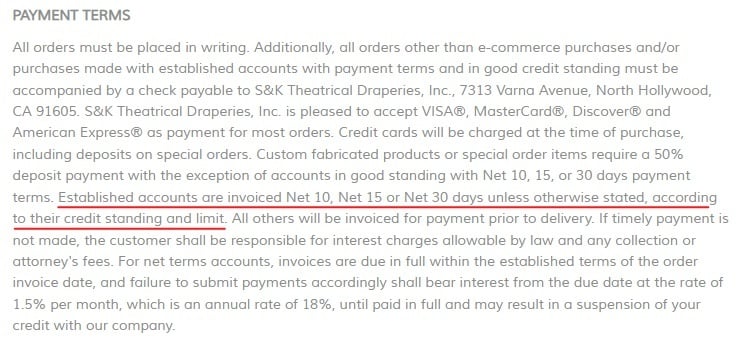

Here's how S&K Theatrical Draperies lays out its Net 10, 15, and 30 policies in its payment terms clause:

Remember, customers may be hesitant to accept your invoice terms if you aren't following industry norms. Talk to peers in the industry to find out what industry norms apply to your industry before setting your invoice terms.

What Payment Methods and Currency You Accept

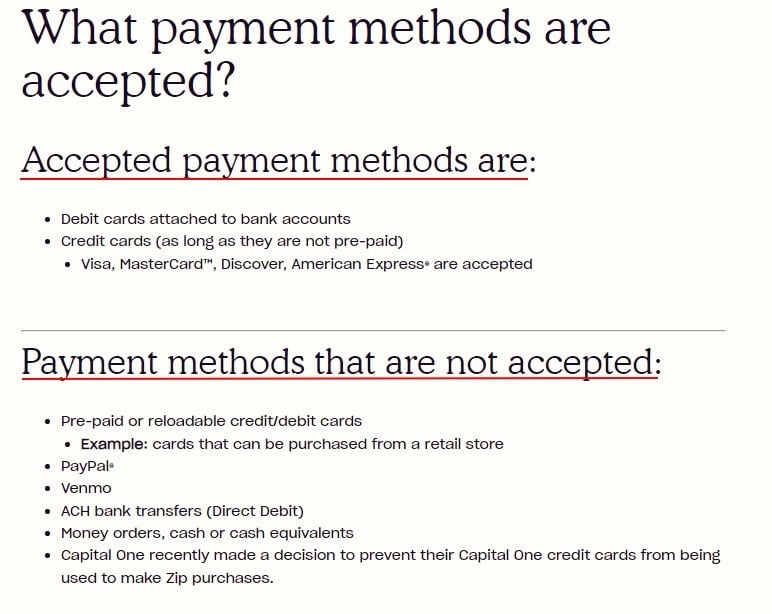

You must specify how you accept payments and how customers can pay you using those methods. This could be bank transfer or direct debit (ACHDebit, bank-debit, credit card, PayPal wallet).

Here's how Zip discloses both what payment methods are accepted, as well as which ones are not acceptable:

Incentives and Offers for Customers (or Potential Customers)

By offering clear terms regarding when payments are due, and any incentives you have in place for ease of payment, your customers will be clear on what's expected from them and more likely to pay you on time.

Some examples of this can be the following:

- Discounts for early payments: For example, "net 30 5/10" means a customer has 30 days to pay in full and will receive a discount of 5 percent if the customer pays the invoice within the first ten days. Your company won't apply the deal if the customer pays later than that.

- Line of credit pay: This is a standard option for larger companies. It allows customers to pay their invoices over time (e.g., monthly or quarterly).

- Estimates and quotes: Estimates are basically a proposal to a prospect that includes a list of products and the estimated cost. You create estimates and quotes for existing or new customers before you start work on a job.

What Happens if Payments are Missed or Not Received

Let customers know what actions you will take in the event of a missed payment. This can be something like immediate cancellation of the account, a 10-day period where interest on the payment accrues if not paid, then the account is cancelled, legal action or anything in between.

Here's how Neil Patel lets users know that if their credit card on file doesn't process, the customer must use another method of payment or risk having the account suspended or terminated, and that collections actions may be taken for any outstanding balances:

While your payment terms clauses may need to include more information, these are the most commonly used clauses that will be applicable in most cases.

Best Practices for Payment Terms Clause in Your Terms and Conditions Agreement

Some of the best practices when it comes to payment terms include using clear language, setting specific payment deadlines, making payment periods shorter, including late fees, offering flexible payment methods and giving incentives for paying early.

Let's look at each of these in more detail.

Use Plain and Polite Language

Being polite and using plain, easy-to-understand language is not only an excellent way to maintain positive relationships with your customers, but it can also help you get your company paid.

For example, a study from Freshbooks showed that including phrases like "please" or "thank you" increases the chances that customers will pay in full and on time.

Set Specific Deadlines

Your business will be able to receive payment quicker if you set clear deadlines. Although it's common to use terms like "Net 30" and "Payment due on receipt," they can be confusing to some customers. Be precise in the language you use for billing due dates.

You can, for example, list the exact due date as "Payment Due 30 days after delivery."

Make Payment Periods Shorter

Your business can reduce the time it takes to get paid by clients. While 30-day billing is still standard, customers can now pay their bills online and via direct transfer. You can start by reducing your payment period from 30 to 21 days. Then, you can evaluate if it makes it easier for you to receive payments quicker.

Include Late Fees and Enforce Them

Customers may be motivated to pay their invoices on time by minor penalties such as a late fee at 2% interest per calendar month. Be sure to communicate your late fee policy to customers using polite but firm language in your Terms and Conditions agreement.

Neil Patel does just that:

If customers fail to pay their invoices in time, they can be charged interest on the entire amount. The calculation would be based upon the number of days that the invoice has been past due, if you choose to do this.

Offer Flexible Payment Methods

Remember that the likelihood of your customers paying in full and on time increases if they have more options for paying their invoices. Customers will be able to choose the most convenient payment method for them.

With that in mind, you should provide your customers with as many payment options as possible to accommodate them and get paid quicker. Customers will be more likely to pay faster if they have a variety of payment options.

These are the most common payment options your business could offer:

- Cash

- Online check out forms

- Accepting multiple different types of credit cards

- Mobile payments

- Accepting Bitcoin and other cryptocurrencies

Reward Customers Who Pay Early

Your customers are more likely to pay you sooner if they receive a discount for paying early. A common reward is to give a 2% discount on the total invoice if the client pays within ten days. However, the invoice is due 30 days after the date it was issued. This is commonly written as 2/10 Net 30.

Summary

Remember that although it's not required by law unless you collect user data, it's pretty smart to include a Terms and Conditions agreement on your website.

Understanding payment terms and including them in your Terms and Conditions agreement can help you safeguard your business financially and set the tone for a good customer relationship.

By defining terms for customers upfront, you decrease your likelihood of dealing with a client who doesn't pay in time or at all. They can be especially helpful for new businesses that may not have much capital to work with or existing businesses that do not want their customers taking too much time paying off invoices.

The standard payment term is "Net 30" which means the customer must make payments within fifteen days from when the invoice was issued, but it might make sense to tweak these terms depending on what works best for all parties involved in each specific industry or business type.

Some of the most common payment terms found in Terms and Conditions agreements are:

- Payment in advance

- Cash on delivery

- Net 7, 10, 30, 60, 90 - Customers must make payment within 7-10, 30, 60, or 90 days of the invoice date

- 2/10 Net30: The net 30 invoice payment terms offer a 2% discount for invoices paid within ten business days. Otherwise, the full invoice amount is due 30 days from the invoice date. An invoice for $1,000 can be paid for $980 if it's paid within ten working days.

- Line of credit pay

- Estimates and quotes

- Recurring payments

You should include payment clauses in your Terms and Conditions agreement that cover the following:

- When you expect to get paid

- The invoice due date

- The currency you prefer

- Payment method and account details

When putting together your payment terms, be sure not to use much legal jargon. Instead, be as clear and straightforward as possible. Try to ensure that your text includes the following if you want to increase the chances that you'll be paid in full and quicker than you otherwise might.

- Set specific deadlines

- Make payment periods shorter

- Include late fees and enforce them

- Offer flexible payment methods

- Reward those who pay early

In terms of offering a variety of ways in which your customers can pay you, consider providing them with the means to pay via:

- Cash

- Online check out forms

- Accepting multiple different types of credit cards

- Mobile payments

- Accepting Bitcoin and other cryptocurrencies

Remember that although it is unlikely that most will read your Terms & Conditions, having a Terms and Conditions agreement that includes your payment terms can be advantageous if a dispute arises between you and your customers.

Comprehensive compliance starts with a Privacy Policy.

Comply with the law with our agreements, policies, and consent banners. Everything is included.