Charting a course through the maze of business entity types, especially in the tech-savvy spheres of app and website development, can often feel overwhelming.

In this comprehensive guide, we unravel the complexities of Sole Proprietorships, Limited Liability Companies (LLCs), and C Corporations, offering a detailed snapshot of their impact on legal liability to empower your decision-making.

More than mere business classifications, these entities carry distinct legal and tax implications. In turn, these may also define the nuances of your Privacy Policy and Terms and Conditions agreements.

TermsFeed is the world's leading generator of legal agreements for websites and apps. With TermsFeed, you can generate:

- 1. An Overview of the Options

- 2. Sole Proprietorship: Definition and Characteristics

- 2.1. Liability is a Risk

- 2.2. How Can You Mitigate the Risk?

- 2.3. Who Presents a Risk?

- 3. Limited Liability Corporation (LLC): Definition and Characteristics

- 3.1. Personal Liability for Your LLC's Debts

- 3.2. Liability for Co-owners' or Employees' Actions

- 3.3. Personal Liability for Your Own Actions

- 3.4. Your LLC's Liability for Members' Personal Debts

- 4. C Corp: Definition and Characteristics

- 4.1. Personal Liability is Limited

- 4.2. Other Benefits of a C Corporation

- 5. Comparing the Options

- 5.1. The Sole Proprietorship

- 5.2. The LLC

- 5.3. The C Corporation

- 6. Every Business Type Needs a Privacy Policy and Terms and Conditions Agreement

- 6.1. Your Privacy Policy

- 6.1.1. What Personal Data is Collected, and How

- 6.1.2. Data Protection Measures

- 6.2. Your Terms and Conditions Agreement

- 6.2.1. Intellectual Property Rights

- 6.2.2. Limitation of Liability

- 6.2.3. Dispute Resolution Mechanisms

- 7. Summary

An Overview of the Options

In the realm of business entities, app and website developers face choices that impact liability and legal documents. Let's explore the following three options:

- Sole Proprietorship

- Limited Liability Company (LLC)

- C Corporation

Keep in mind that whether you're a sole proprietor, LLC, or C Corp, your website likely handles user data and thus will legally need a Privacy Policy. A Privacy Policy outlines how you collect, use, and protect this data, meeting global privacy laws and building trust with users.

You should also have a Terms and Conditions agreement regardless of what type of business you operate. This agreement will lay out site usage rules, limit your liabilities, and define acceptable user interactions. We'll discuss this further on in the article.

Now let's take a deeper look at the different types of business entities.

Sole Proprietorship: Definition and Characteristics

As you start off on your entrepreneurial journey as an app or web developer, you might find the notion of a sole proprietorship appealing. Offering a simple, uncluttered structure, sole proprietorships are a favorite among freelancers, consultants, and other one-owner operations.

Whether you're coding solo or developing websites, this business structure could fit your needs very well. However, it's crucial to understand that this simplicity comes with legal implications, particularly regarding liability.

Liability is a Risk

Sole proprietorships come with a higher liability risk than other models. This is because as a sole proprietor you're personally liable for all claims against your business. This is unlike an LLC or a corporation, as you'll see in the following sections.

Picture a lawsuit lost or a debt incurred by your business, and understand that both the business and you personally are on the line.

How Can You Mitigate the Risk?

Begin by identifying your vulnerabilities. Most claims aren't spontaneous eruptions. They're foreseeable and very often preventable events. As a sole proprietor, you're likely to face several types of risks, chief among them being contract and tort claims.

Contract claims often arise when an agreement, be it written or oral, is breached or alleged to have been breached. An aggrieved party could sue your business if, for instance, a contract for app development isn't fulfilled as promised.

Meanwhile, tort claims, which may not be as common but are often more severe, emerge when a person is injured - financially or personally - due to an action unrelated to a contract. For instance, if an employee causes harm through negligence, your business could be held accountable.

Therefore, it's crucial to focus a significant portion of your risk management efforts on preventing these types of claims.

Who Presents a Risk?

While being a sole proprietor eliminates the risk of lawsuits from co-owners, several other parties may pose potential legal risks.

For example:

- Employees could allege wrongful termination or discrimination

- Landlords might take issue with a lease

- Suppliers/vendors could raise disputes over goods purchased

- Customers may take umbrage over perceived breaches of contract

All these parties could potentially instigate both contract and tort claims.

Additionally, complying with the vast array of laws and regulations affecting businesses is non-negotiable. These include things such as safety standards, land use laws, privacy laws, and employment regulations.

Neglecting them, whether out of ignorance or neglect, could find you and your business facing legal liability.

Limited Liability Corporation (LLC): Definition and Characteristics

Picture an LLC as a protective shield for your business. It works as a buffer against some of the potentially harsh impacts of the professional world.

The LLC is a standout entity in the business universe. Its distinctiveness arises from the fact that it operates as a legal structure rather than a tax entity.

It also provides a number of benefits including limited legal liability for owners (known as members) as well as managers.

With LLC's the question always arises: How limited is the legal liability? The answer is that it is significantly limited, but with nuances. The main allure of forming an LLC is the provision of a safety net against personal liability for business debts.

Your LLC is the entity responsible for any debts and liabilities incurred. The owners and managers are not responsible. However, this isn't an infallible mechanism. The degree of protection may depend on the state in which your LLC is incorporated.

As an app or web developer considering an LLC, consider the following key liability concerns.

Personal Liability for Your LLC's Debts

Forming an LLC generally protects your personal assets from business debts. Unless you've personally guaranteed your business's debts, your personal property remains untouched.

However, creditors may demand personal guarantees for business loans or credit, making you personally liable if your LLC's assets prove insufficient.

Liability for Co-owners' or Employees' Actions

The LLC structure offers protection from personal liability for any misconduct by the co-owners or employees during business operations. Any debts or judgments against the LLC will be paid using the LLC's assets, not the personal assets of the owners.

Personal Liability for Your Own Actions

Forming an LLC doesn't provide immunity from your own misconduct. If you're negligent or act improperly during your business operations, you could still be held personally accountable.

For instance, you could be held liable if you negligently injure someone, fail to deposit withheld employee taxes, act recklessly or illegally, or if you treat your LLC as an extension of your personal affairs.

Your LLC's Liability for Members' Personal Debts

Members' personal debts can't typically be paid from the LLC's assets. However, creditors can sometimes collect from an LLC owner, though the rules vary by state.

Options include seeking a court order to demand payment from the LLC to the creditor, foreclosing on the owner's LLC ownership interest, or seeking a court order to dissolve the LLC.

The reality is that an LLC's liability shield isn't bulletproof.

Its strength can fluctuate depending on state laws, the nature of the business debt, the behavior of the LLC owners and employees, and the owner's personal conduct. Therefore, it's crucial for app or web developers to carefully consider these factors before embarking on their entrepreneurial journey with an LLC.

Remember, while the LLC structure can serve as a shield against many legal liabilities, it can't protect you from everything. Keep in mind the importance of having liability insurance, too.

Always consult with a legal professional to understand all aspects of forming an LLC and the responsibilities you will carry as a member.

C Corp: Definition and Characteristics

Engaging in the digital development realm means you might find yourself outgrowing the confines of your Limited Liability Company (LLC).

When your creativity as an app or web developer attracts an expansive pool of investors, or your business needs to diversify its share class structures, the LLC might prove limiting. Enter the C Corporation (C Corp), a business structure designed to cater to your growing needs.

The C Corp's main appeal is its limitation of liability.

As a business owner, the fear of personal liability might have crossed your mind when deciding on a suitable business structure. With a C Corp, this concern can be significantly mitigated.

Personal Liability is Limited

Typically, as a C Corp owner, your personal liability for the corporation's debts and obligations is significantly limited. This means that even in turbulent financial waters, your personal assets remain safe, distinguishing the C Corp structure from partnerships or sole proprietorships.

However, this rule is not absolute and carries certain exceptions.

A C Corp owner might find themselves personally liable under specific circumstances. These situations can include:

- Personal infliction of injury to a third party

- Failing to remit deducted taxes from employee wages

- Personal guarantees on business debts

- Engaging in fraudulent or illegal activities

Moreover, a court could deem personal liability if it views the corporation as an extension of the owner or if it concludes that the C Corp doesn't genuinely exist.

Understanding the C Corp structure provides insight into its liability dynamics. Upon incorporating a business, it's typically treated as a C Corp, a separate and distinct legal entity. This means that when legal disputes arise, owners are only liable under the aforementioned exceptions.

More often than not, their personal assets remain untouchable.

Other Benefits of a C Corporation

Besides the significant protection from liability for shareholders, C Corps can raise capital more effortlessly compared to partnerships or sole proprietorships by selling stocks. This attribute, coupled with the possibility of additional earnings through dividends, makes them attractive to investors.

Moreover, C Corps can potentially lure talented employees with a raft of benefits, including fringe benefits and stock options. Additionally, C Corps are at liberty to deduct fringe benefits as business expenses, providing they meet certain stipulations.

This, along with more relaxed ownership transfer rules and enhanced business credibility, forms part of the compelling case for the C Corp structure.

Comparing the Options

In the high-stakes arena of app or web development, the type of business structure you choose has profound implications for your personal liability. Sole proprietorships, LLCs, and C Corporations (C Corp) each carry their unique blend of liability attributes.

The Sole Proprietorship

When you opt for a sole proprietorship, the simplicity of the business model is juxtaposed against the stark reality of personal liability for all business obligations. This structure exposes you to a multitude of legal risks, including contract and tort claims.

This unlimited liability is an ever-present shadow that extends to your personal assets, making it necessary for you to be vigilant and proactive in mitigating these risks.

The LLC

Contrastingly, an LLC acts as a protective shield, insulating your personal assets from business debts and liabilities, barring certain exceptions.

The LLC's armor isn't infallible, however. Its protective veil can be pierced under specific circumstances, such as negligent or fraudulent actions by the owner or if the LLC is treated as an extension of personal affairs.

Still, its inherent liability limitations make it a more enticing choice compared to sole proprietorship for many developers.

The C Corporation

At the other end of the spectrum, C Corps offer a heightened degree of liability protection.

As a separate legal entity, a C Corp shields its owners from personal liability for corporate debts unless specific exceptions apply. Despite its more complex structure, C Corps offer a distinct allure for growing businesses with more significant needs, particularly in terms of raising capital and offering a broader range of benefits to attract talent.

Every Business Type Needs a Privacy Policy and Terms and Conditions Agreement

Every business, regardless of its legal structure, must comply with privacy laws.

Ranging from the EU's GDPR to California's CCPA (CPRA) and Brazil's LGPD, these legislations mandate transparency in handling consumer data and call for businesses to publish a compliant Privacy Policy.

While you aren't legally required to have a Terms and Conditions agreement, having one provides huge benefits including in the realm of legal liability, which can help bolster whatever business type you choose.

Your Privacy Policy

Having a robust, legally compliant Privacy Policy is a necessity. Your Privacy Policy should disclose the specifics of the data you're collecting, the reasons behind its collection, and the safeguards you've employed for its protection.

While the nuanced and specific requirements of your Privacy Policy can change depending on what laws you must comply with, generally every Privacy Policy should include the following information:

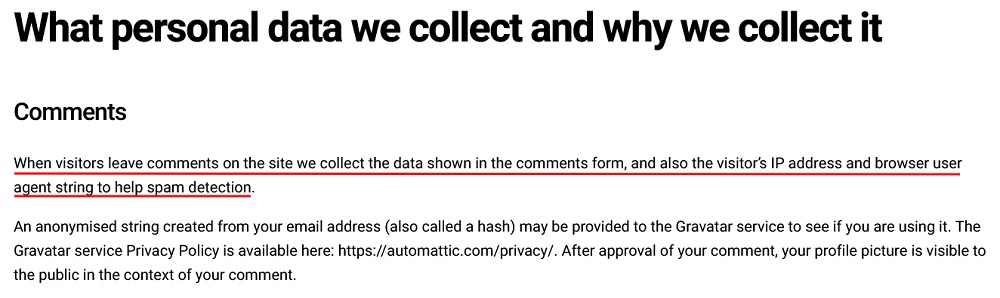

What Personal Data is Collected, and How

Your Privacy Policy must disclose what personal data you collect and what methods of collection you use.

Users are entitled to know why their data is being harvested. Be it for service improvement, personalization, or marketing, ensure your motives are made clear.

Be precise and thorough.

Here's how Giant Jellyfish, a graphic design sole proprietorship, specifies that it collects data from user comments when users leave them, and that it also collects IP addresses to help with spam detection:

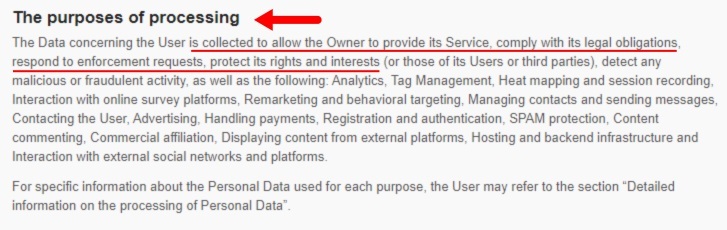

Copyblogger, a well-known LLC, lets users know the reasons for its data collection:

Data Protection Measures

Illustrate your commitment to data security by describing the measures you use to protect user data, from encryption to two-factor authentication and regular security audits. While you don't have to detail your exact security mechanisms, you should at least let it be known that you do consider security and take it seriously.

Clients On Demand, an LLC, makes sure users know the company protects their data in a security clause:

For more information on Privacy Policies, check out some of our feature articles:

- What Does a Privacy Policy Need to Include?

- Business Privacy Policy Template

- Mobile App Privacy Policy Template

Your Terms and Conditions Agreement

Here are some commonly seen clauses in a Terms and Conditions agreement.

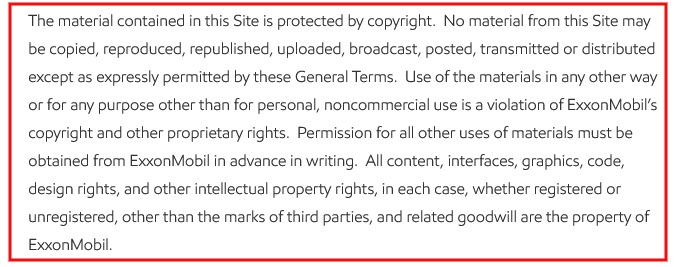

Intellectual Property Rights

Your Terms and Conditions agreement is a great way to present your intellectual property and copyright information. Delineate the ownership and usage rights of your website or app content, covering copyrights, trademarks, patents, and other relevant intellectual property.

Here's how Exxon-Mobile, a C Corporation, writes its clause on this subject:

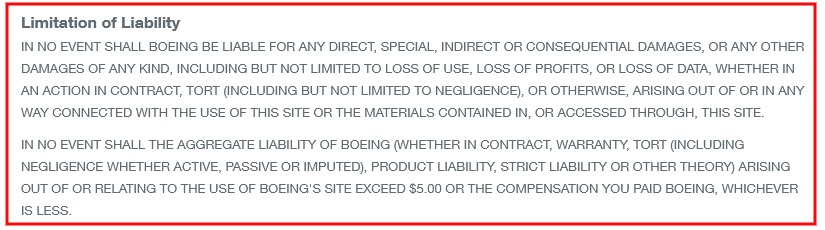

Limitation of Liability

Always take steps to safeguard your business by including a Limitation of Liability clause in your Terms agreement. Essentially, this clause protects you from bearing the brunt of potential user-incurred damages.

Boeing, another C Corporation, puts its clause on this section together like this:

Dispute Resolution Mechanisms

Outline the process for resolving disputes between your business and users. This could involve arbitration agreements or a specified jurisdiction for legal disputes.

AlignPay, another corporation, presents this subject in the following manner:

For more information on creating a Terms and Conditions agreement, check out a few of our feature articles:

Summary

The choice of business structure - sole proprietorship, LLC, or C Corporation - significantly influences the personal liability of app or web developers.

While sole proprietorships carry unlimited liability for business obligations, LLCs provide more protection, save for exceptions like owner misconduct. C Corps, though more complex, offer greater liability protection.

Regardless of structure, all businesses must abide by international privacy laws and maintain a robust Privacy Policy and Terms and Conditions agreement.

These documents define data handling, protection measures, intellectual property rights, liability limitations, and dispute resolution mechanisms. Remember, compliance isn't optional - protect your business with TermsFeed's resources today.

Comprehensive compliance starts with a Privacy Policy.

Comply with the law with our agreements, policies, and consent banners. Everything is included.