A liability waiver is a legal agreement that alerts potential customers about inherent dangers with your services and tells them you're not liable for mishaps.

Though liability waivers are commonly used by businesses with a higher risk of injury or damages (e.g., fitness, healthcare, outdoor recreation, etc.), they can be used by any business, regardless of industry.

This article will go over everything you need to know about liability waivers, including what they are, why you need them, how to draft one, and much more.

Let's get into it.

What customers say about TermsFeed:

This really is the most incredible service that most website owners should consider using.

Easy to generate custom policies in minutes & having the peace of mind & protection these policies can offer is priceless. Will definitely recommend it to others. Thank you.

- Bluesky's review for TermsFeed. Read all our testimonials here.

With TermsFeed, you can generate:

- 1. What is a Liability Waiver?

- 2. Why Do You Need a Liability Waiver?

- 3. Are there Different Types of Liability Waivers?

- 4. How Do You Write a Liability Waiver?

- 4.1. Introductory or Cautionary Statement

- 4.2. Summary of Inherent Risks

- 4.3. Assumption of Risks

- 4.4. Release Clause

- 4.5. Indemnification

- 4.6. Governing Law

- 4.7. Consent, Confirmation and Signature

- 5. How Do You Format a Liability Waiver?

- 6. Are Liability Waivers Legally Binding?

- 7. When are Liability Waivers Not Enforceable?

- 8. Can Customers Sign My Liability Waiver Online?

- 9. Can Minors Sign My Liability Waiver?

- 10. What are the Differences Between a Liability Waiver and a Disclaimer?

- 11. Summary

What is a Liability Waiver?

A liability waiver is a contract that protects your business from claims and lawsuits for damages suffered due to the inherent hazards of your services.

Think of it as a warning label with a legal protection feature. It tells your customers three key things:

- Your service carries inherent risks

- By using your service, customers accept these risks, and

- Customers agree not to hold your business responsible for accidents

Liability waivers go by many names, including waiver of liability, release forms, hold harmless agreements, exculpatory clauses, and indemnity agreements.

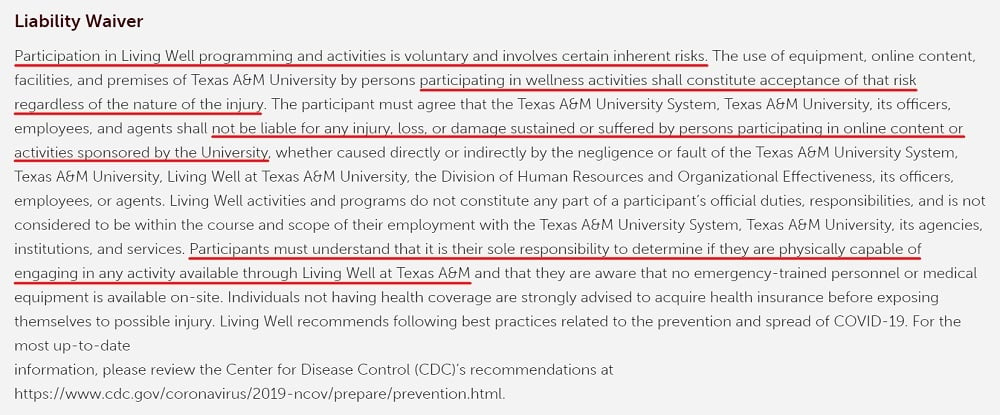

Here's an example of a liability waiver from the Living Well program at Texas A&M University:

While this example can certainly benefit from some readability enhancements, it serves the purpose all the same.

Why Do You Need a Liability Waiver?

A liability waiver provides an extra layer of protection from legal disputes. It's especially important if you have a delicate profession or offer risky experiences.

If a customer reads, accepts, and signs your liability waiver, the responsibility for injuries and other damages becomes theirs rather than yours. However, this is subject to certain conditions, as we'll cover below.

Another important reason to have a liability waiver is to set clear expectations for customers. In other words, customers can screen the potential dangers of your activities to decide if they can and are willing to participate.

For instance, it's obviously not a good idea for a customer with an underlying health issue (e.g., heart condition) to participate in certain thrill-seeking activities (e.g., roller coaster rides, jet skiing, etc).

By maintaining a liability waiver, customers can fully understand what they're getting into before deciding to engage your services.

Are there Different Types of Liability Waivers?

Liability waivers aren't so much of different types as they're tailored to different industries. So, while the terms and content may vary depending on the nature of your business, the core elements of a liability waiver remain consistent across industries.

That being said, many sources still classify liability waivers based on the specific industry and claims they cover. Some of the more common ones are as follows:

- General liability waivers: A general liability waiver is an all-rounder. It broadly covers various claims, including negligence, injury, death, etc. These waivers are typically used for activities like horseback riding, gym memberships, zip-lining, travel and tourism, etc.

- Insurance liability waivers: Insurance waivers protect insurance companies from lawsuits after settling a claim. By signing this waiver, customers agree to release the insurance company from all liability and to accept settlements as full and final payment.

- Event liability waivers: Tailored for event organizers, this waiver protects against liability for risks associated with concerts, festivals, sporting events, etc.

- Professional liability waivers: As the name implies, a professional liability waiver is tailored for professionals, such as doctors, lawyers, dentists, accountants, engineers, etc.

- Property liability waivers: For landlords and property owners, this waiver helps guard against liability for damages associated with property damage, rental agreements, leases, etc.

How Do You Write a Liability Waiver?

A well-constructed liability waiver includes a number of key clauses and sections to establish a mutual understanding between you and your customers.

Let's go over each in turn to help you get started on drafting yours.

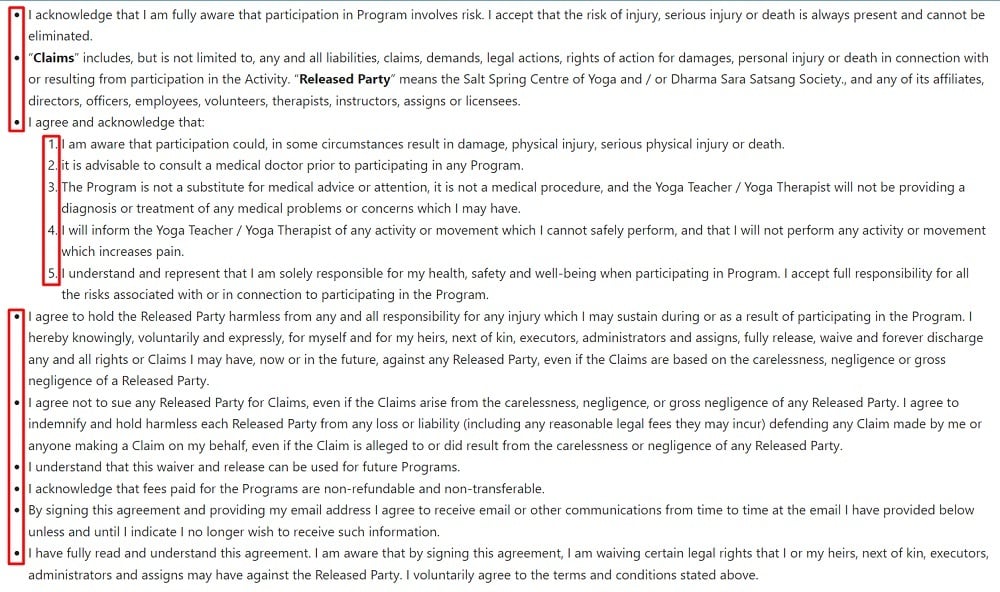

Introductory or Cautionary Statement

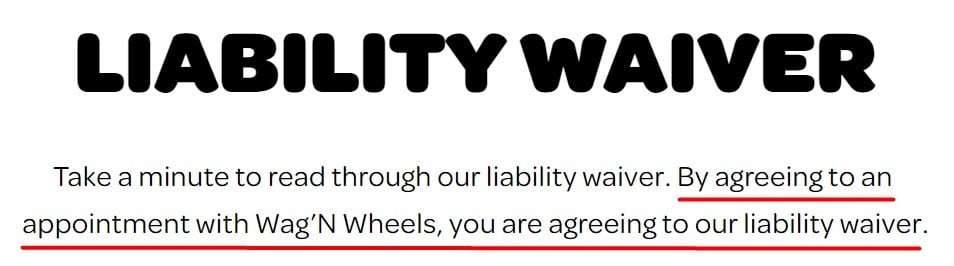

Start your liability waiver with a clear and prominent introductory/cautionary statement that highlights what the agreement is about and tells customers they must agree to the terms before participating.

It could go something like: "Please read our liability waiver carefully. By signing this waiver, you accept the risks and terms within."

Here's an example from Wag'N Wheels:

Here's another example from the Salt Spring Centre of Yoga:

And here's one more from Pilates Coven, combining its liability waiver with its Disclaimer:

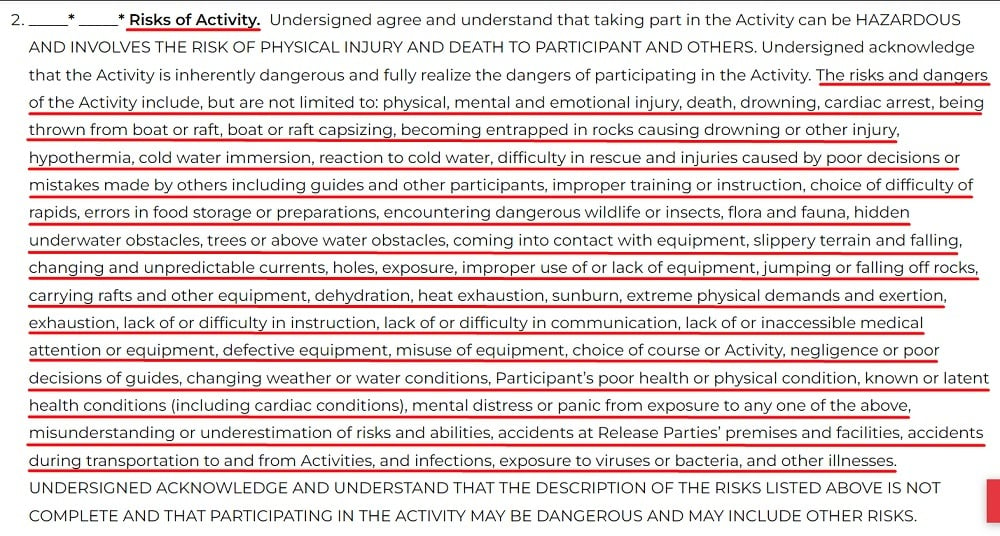

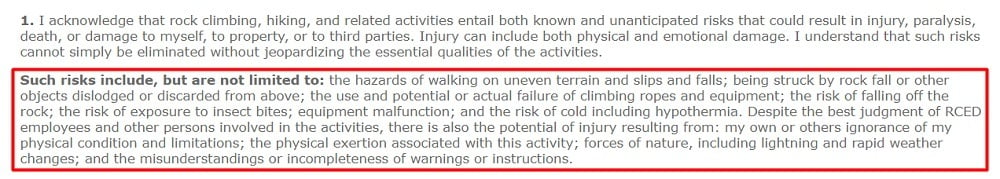

Summary of Inherent Risks

Next, your liability waiver needs to outline the inherent risks in your business activities or services. As with most legal contracts, the more details you provide, the better.

To make your liability waiver airtight, it's a good idea to get into specifics, including potential scenarios (even the most unlikely) that may occur in your line of business.

For instance, if you run a paintball business, your liability waiver would include risks like bruises, minor injuries, and accidental collisions. How about a bungee jumping service? It would outline risks like falls, equipment malfunctions, and environmental hazards.

Here's how Kodi Rafting, a whitewater rafting company, spells out specific risks for its activity in comprehensive detail:

Here's another example from Rock Climb Every Day:

To ensure easy understanding for customers, it would be ideal to use a numbered or bullet list when setting out these risk scenarios.

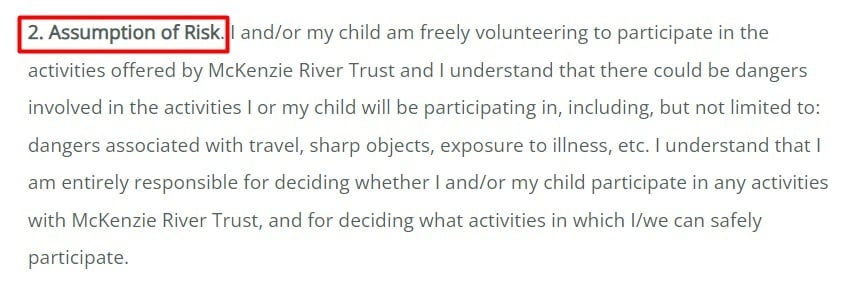

Assumption of Risks

In this section, clearly state that customers understand and voluntarily accept all risks mentioned above. This serves to shift responsibility from your business to customers.

Here's an example of how this can look from McKenzie River Trust:

And here's how The Yard sets out its assumption and acknowledgment of risks section in its liability waiver:

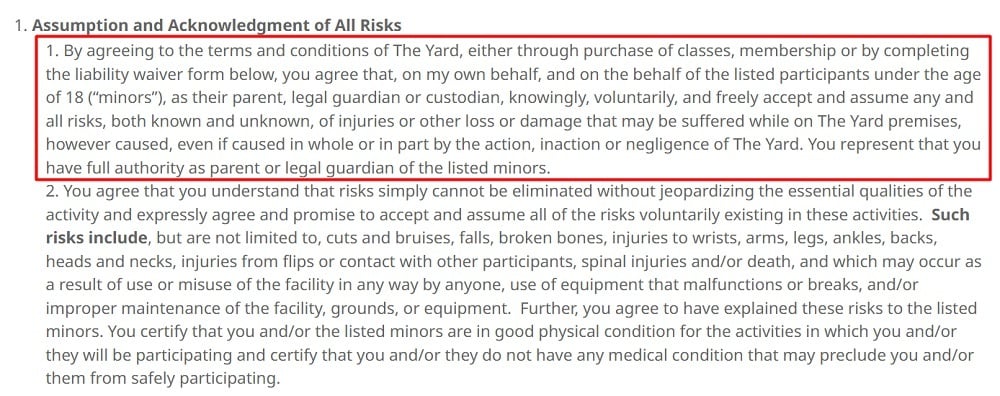

Release Clause

Arguably the most important section of your liability waiver, the release clause tells customers that they agree not to hold your business responsible for injuries or damages they may sustain during your activities.

Once again, The Yard does this well:

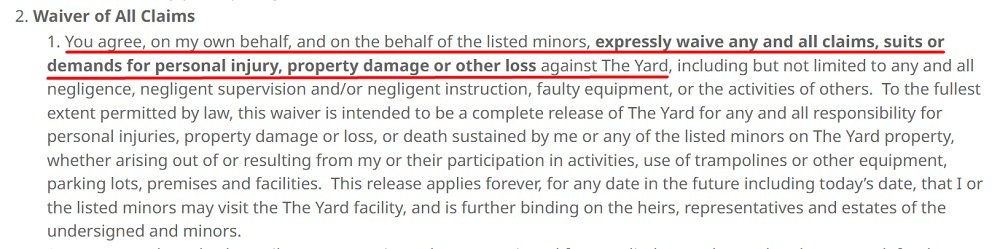

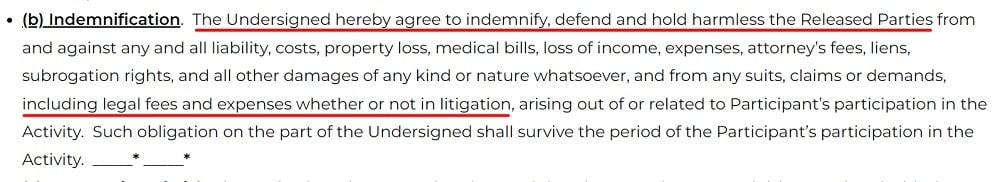

Indemnification

Most liability waivers include an indemnification clause. It essentially states that customers agree to reimburse your business for any costs you incur due to a claim or lawsuit. This may include attorney fees, damages awarded, and settlements.

Here's an example from Kodi Rafting:

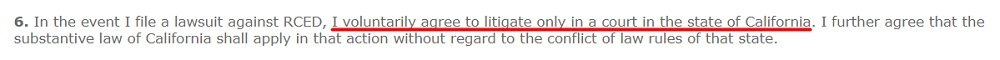

Governing Law

A governing law clause clarifies which state's laws will be used to interpret your liability waiver in case of legal dispute. Ideally, this is the state where your business operates.

Rock Climb Every Day uses a short, simple statement to do this:

Notably, the choice of law clause is a feature liability waivers have in common with Terms and Conditions agreements - another important legal document to maintain.

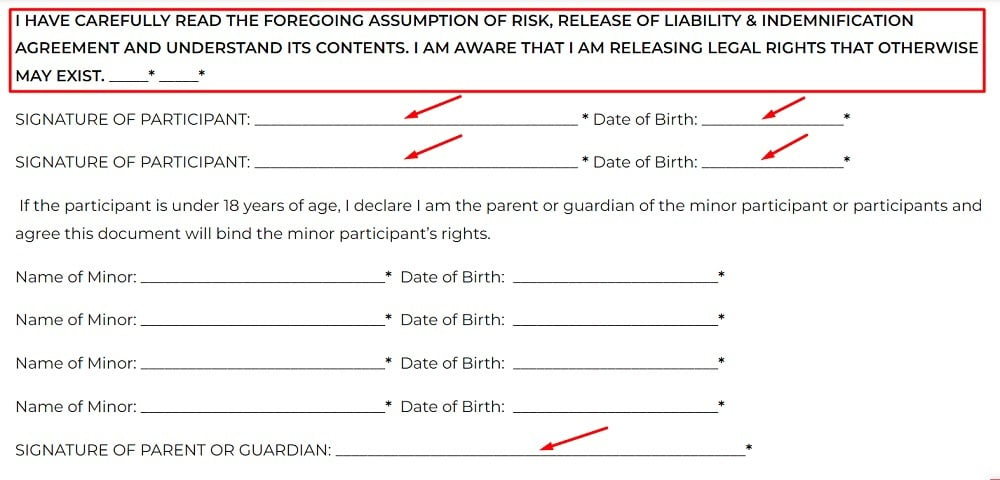

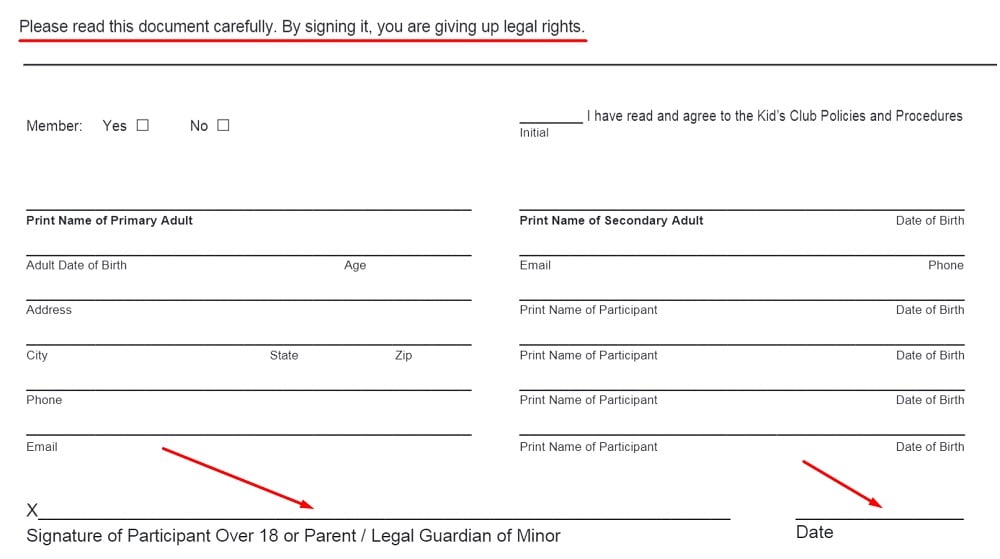

Consent, Confirmation and Signature

Wrap up your liability waiver with a section where customers can confirm that they've read, understood, and accepted your terms.

This could be a simple statement like: "I have read and understood the risks and agree to the terms above."

This section will also work to show that the customer consented to the terms of the liability waiver.

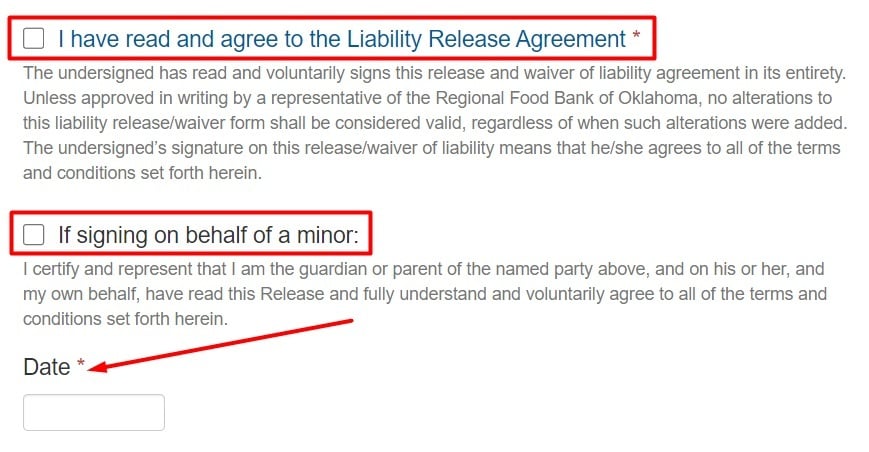

To make this confirmation legally binding, you'll need customers' signatures and relevant dates of the agreement. You should also provide a separate section for parents and guardians signing on behalf of minors.

Here's how Kodi Rafting does this:

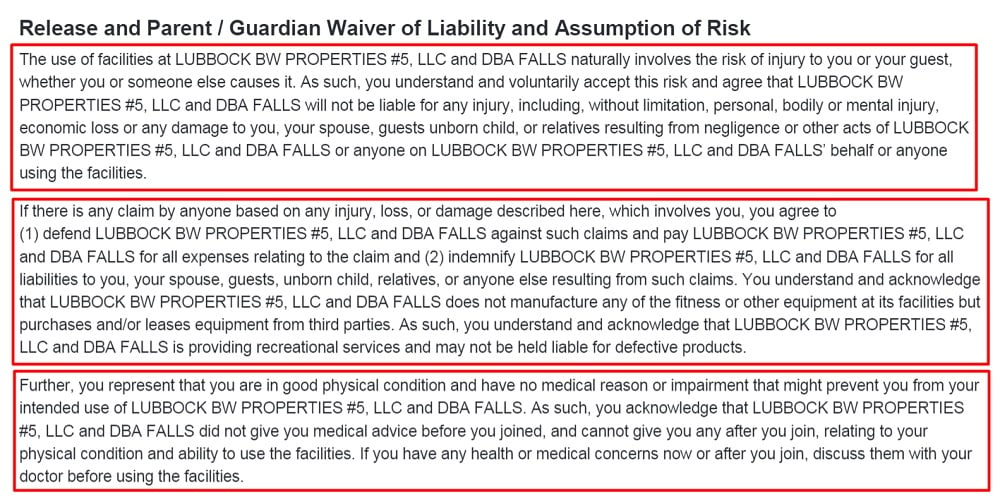

And here's how The Falls Tennis and Athletic Club does this:

Now that your liability waiver is written, let's see how to format it to make it clear and easily understandable.

How Do You Format a Liability Waiver?

It's not enough to simply write up a liability waiver. You need to optimize it for clarity and readability. In many jurisdictions, a waiver's enforceability depends on how clear, thorough, and easy it is to understand.

To make your liability waiver legally sound, consider these key formatting tips:

- Have a concise and descriptive title: Your title should highlight the contract as a liability waiver and briefly explain its purpose.

- Use clear sections: Divide your liability waiver into sections with clear subheadings and short paragraphs. This not only enhances readability but also keeps things neat and organized.

- Include numbered or bulleted lists: Consider using numbered or bulleted lists where practical to convey specific details (e.g., risk scenarios) and keep your liability waiver simple and well-structured.

- Write in simple language: Avoid legal jargon and complex sentences to make your liability waiver straightforward and easy to understand.

To illustrate, here's how the Salt Spring Centre of Yoga uses both numbered and bullet lists to break up its liability waiver into easily digestible chunks:

And here's how the Falls Tennis and Athletic Club uses short paragraphs to help with readability:

It's worth noting that you can use online templates to jumpstart the process as well as save time and effort when drafting your liability waiver. However, you should always have your waiver reviewed by a professional before using it.

Are Liability Waivers Legally Binding?

Yes, liability waivers can be legally binding documents. However, their enforceability depends primarily on whether the laws of your region support it.

For instance, as of January 2022 in the U.S., liability waivers were upheld in 46 states, reluctantly accepted in 1 (Connecticut), and rejected outright by 3 (Louisiana, Montana, and Virginia).

It's, therefore, advisable to seek legal or professional guidance to ensure your waiver is well-drafted and legally valid for your location.

Other relevant factors that determine the enforceability of liability waivers include:

- The terms and language used

- The unique circumstances of a case

- The nature of the business service or activity

Liability waivers are typically effective only when they're clear, specific, voluntarily accepted, and properly highlight the inherent dangers of an activity.

To illustrate, consider the case of Zivich v. Mentor Soccer Club, Inc. In this case, a participant in a soccer match was injured, but the club had a signed liability waiver as protection against the inherent risks of the sport.

Ultimately, the court ruled in favor of the soccer club because the terms of the waiver were fair, and no gross negligence was involved.

When are Liability Waivers Not Enforceable?

While effective for legal protection, liability waivers aren't foolproof. In cases of extreme negligence, intentional harm, or similar circumstances, these waivers will not hold up in court.

In other words, if your business services have little to no consideration for safety, a liability waiver won't protect you from claims and lawsuits when injuries occur.

To push that point home, consider the Santa Barbara v. Superior Court case. Despite the protection of a liability waiver for a mountain biking race, the court ruled that the waiver was unenforceable because:

- It was against public policy

- The organizer was grossly negligent, resulting in injuries

Can Customers Sign My Liability Waiver Online?

Yes, customers can sign your liability waiver online. In fact, digital liability waivers are the generally preferred option since they're more convenient and efficient for all.

If you offer your liability waiver online, the best way to get a customer's confirmation and signature is through an empty 'I Agree' checkbox next to an explanation of what customers are agreeing to.

Here's how the Regional Food Bank of Oklahoma does this, including provisions for signing on behalf of minors and the date of the agreement:

Can Minors Sign My Liability Waiver?

In general, minors (typically under 18) can't legally enter into contracts and, as such, can't sign a liability waiver. Instead, you'd need parents or legal guardians to sign for minors to make your waiver legally binding.

What are the Differences Between a Liability Waiver and a Disclaimer?

Liability waivers are sometimes compared to disclaimers since they both protect businesses from legal liability.

In the chart below, we unpack the key differences between both legal agreements.

| Key Areas | Liability Waiver | Disclaimer |

| Definition | A legal document that protects your business by having customers waive their right to sue for injuries or damages arising from inherent risks of your service. | A statement that highlights important details about your product or service while limiting your liability. You can find an example at the end of this article. |

| Purpose | Shields your business against liability claims from customers who participate in your activities. | Limits liability and manages customer expectations for specific products, services, or informational content. |

| Scope | Focuses on a specific activity or service, outlining inherent risks and customers' agreement not to hold your business accountable for damages. | Broadly addresses general information or limitations, often seen in product descriptions, service terms, or informational content. |

| Content | Includes a detailed summary of risks, assumption of risk, release clause, and confirmation through signatures. | A simple notice, warning, or cautionary statement, often placed within Terms and Conditions, product labels, or informational material. |

| Enforceability | Enforceable when properly drafted, transparent, signed, and if legal jurisdiction permits it. | Enforceable when transparent and compliant with relevant law and industry guidelines. |

Summary

A liability waiver is your defense against legal liabilities arising from the inherent risks of your business services.

It's a legal contract that tells customers about these risks, requires their acknowledgment, and asks them not to hold your business responsible for accidents.

Though liability waivers can be effective legal protection tools, they aren't without limits. In cases of extreme negligence and intentional harm, these waivers may be dismissed under law.

The specific content of a liability waiver may differ depending on the industry where you operate. That said, a valid liability waiver should at least include the following details:

- Introductory or cautionary statement

- A detailed account of the inherent dangers

- Assumption of risks

- Release clause

- Indemnification

- Choice of law

- A confirmation and signature section

When drafting your liability waiver, pay special attention to the language and format. This may mean the difference between a waiver that holds up in court and one that doesn't.

A clear and thorough liability waiver sets the foundation for a transparent relationship with your customers. It helps them understand inherent dangers while protecting your business from legal problems.

Comprehensive compliance starts with a Privacy Policy.

Comply with the law with our agreements, policies, and consent banners. Everything is included.